Gabriel Mihalache

International Economics

Welcome to my website; I study topics in International Economics and Macroeconomics. My work explores the consequences of sovereign default risk for the maturity structure of public debt, sectoral reallocation, capital accumulation, and fiscal-monetary interactions. I am an Assistant Professor of Economics at The Ohio State University. I received my PhD in 2016 from the University of Rochester. If you're curious, this is how you pronounce my last name.

Working Papers

- "Global Imbalances, Trade, and Sovereign Risk," Nov 2025

with Yan Bai, Minjie Deng, and Chang Liu

work-in-progress

Publications

- "Monetary Policy and Sovereign Risk in Emerging Economies (NK-Default),"

with Cristina Arellano and Yan Bai

The Quarterly Journal of Economics, 2026, 141(2), ISSN 0033-5533 - "Insufficient or Excessive Investment Under Sovereign Default Risk,"

with Ilhwan Song

Journal of International Economics, 2026, 160, ISSN 0022-1996 - "Default and Development,"

with Lei Li

Journal of International Economics, 2025, 155C, ISSN 0022-1996 - "Solving default models,"

Oxford Research Encyclopedia of Economics and Finance, 2025 - "Comment on `On Wars Sanctions and Sovereign Defaults' by Bianchi and Sosa-Padilla,"

Journal of Monetary Economics (C-R-NYU 100th Meeting), 2024, 141, ISSN 1873-1295 - "Deadly Debt Crises: COVID-19 in Emerging Markets,"

with Cristina Arellano and Yan Bai

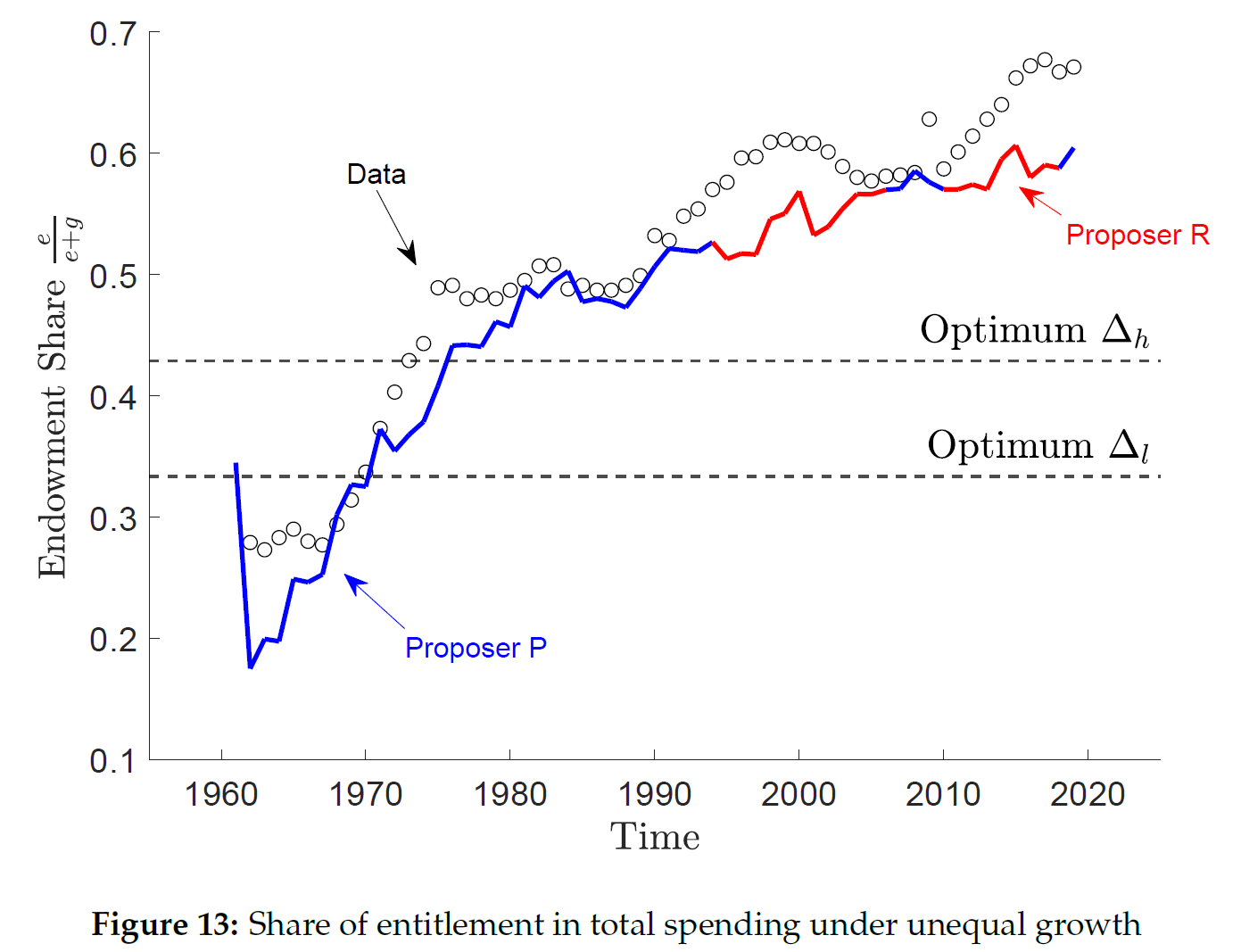

The Review of Economic Studies, 2023, 91(3), ISSN 0034-6527 - "Bargaining over Taxes and Entitlements in the Era of Unequal Growth,"

with Marina Azzimonti and Laura Karpuska

International Economic Review, 2023, 64(3), ISSN 0020-6598 - "COVID-19 Vaccination and Financial Frictions,"

with Cristina Arellano and Yan Bai

IMF Economic Review, 2023, 71(1), ISSN 2041-4161 - "Sovereign Default Resolution Through Maturity Extension,"

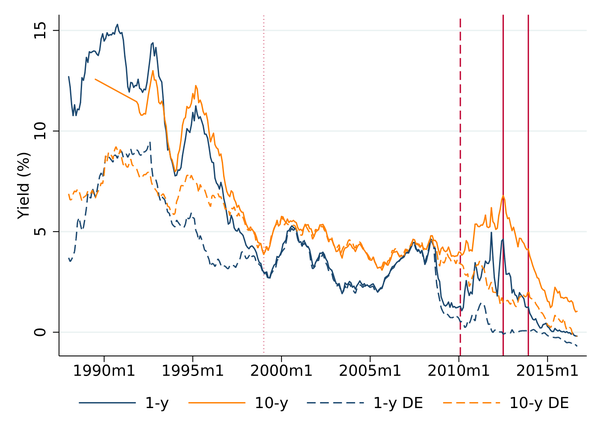

Journal of International Economics, 2020, 125C, ISSN 0022-1996 - "Default Risk, Sectoral Reallocation, and Persistent Recessions,"

with Cristina Arellano and Yan Bai

Journal of International Economics, 2018, 112, ISSN 0022-1996 - "The Payment Schedule of Sovereign Debt,"

with Yan Bai and Seon Tae Kim

Economics Letters, 2017, 161, ISSN 0165-1765

Resources

- Computation: Compilers, IDEs, languages, libraries for numerical methods

- Sovereign default reading list: key papers on quantitative models of (equilibrium) sovereign default

- A Fortran+MATLAB Workflow, for moving data or results back and forth

Teaching

All materials, including syllabi and recordings, are distributed via Carmen. Class-specific office hours are listed in the syllabus. For other appointments, please email. Students, please use mihalache.2@osu.edu and include the class name in the subject. Thank you!

Spring 2026

- ECON 4002.02 Intermediate Macroeconomics Theory

- ECON 5660 Financial Aspects of International Trade

- ECON 8862 International Economics 2 (PhD)

Previously

- ECON 5660 Financial Aspects of International Trade

- ECON 8862 International Economics 2 (PhD)

- At Stony Brook University:

- ECO 305 Intermediate Macroeconomic Theory

- ECO 325 International Trade

- ECO 386 International Finance

- ECO 531 Introduction to Computational Methods in Economics (MA)

- ECO 610 Advanced Macroeconomic Theory (PhD)

- ECO 613 Computational Macroeconomics (PhD)

Are you considering asking me to write a reference letter in support fo your grad school applications? Please read carefully the information available here, to help me help you. Thank you!

Door Decorations

It is traditional for academics to decorate their office doors with snippets from articles, media, social commentary, quotes, or cartoons. These are the current content on my door, as of Jan 2025:

- "The Ends of Four Big Inflations" – T.J. Sargent, 1981

- "Japan's Phillips Curve Looks Like Japan" – G.W. Smith, 2006

- "University of California at Berkley graduation speech" – T.J. Sargent, 2007

- "Asset Pricing with Garbage" – A. Savov, 2011

- "Brazil: Inflation and stabilization plans" – Ayres et al., 2019

- A small USA flag, which I received at my naturalization ceremony